Background

I find it really weird that this fundamental fact about our money system is not widely known.

Many people stress national debts. They’re too big, creating money is inherently inflationary, creating too much money will cause hyperinflation, etc.

And most people who make such statements seem unaware that currency issuing governments create only a small portion of the money we use.

The rest is created by commercial banks.

I’ve read that central banks create about 3% to 5% of the money in circulation, which means commercial banks create 95% to 97%, but I’ve not found specific sources to corroborate these numbers.

It is however easy to find sources that document that commercial banks create most of the money in circulation.123

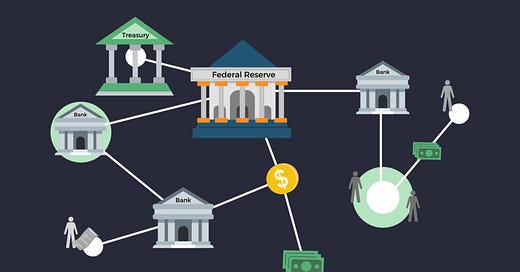

I find it helpful to think of modern banking as a franchise system, where the central banks are the franchisees and commercial banks are the franchisors.

The diagram below4 provides an illustration of that idea.

Brief segue about the fractional reserve banking model

And I’ll explain how even thought it is still taught, it can not possibly be true.

It is easy to find sources that describe the money multiplier of fractional reserve banking. But below are reasons this model can not be correct.

The first reason is many countries have a reserve requirement of 0%, and a 0% reserve requirement means there is no reserve requirement.

The list of such countries is:

Canada

United Kingdom

New Zealand

Australia

Sweden

Hong Kong

Denmark

Norway

and as of March 26 2020, the United States.5

People have argued that a fractional reserve banking system can still operate with a 0% reserve requirement.

But in the fractional reserve banking model the reserve ratio is the percentage of every dollar of reserves that can not be lent out. And if that number is 0%, calling that fractional reserve banking is silly. Banks are required by law to keep 0% of their reserves and not lend them out?

The second reason the fractional reserve banking model has to be false is that banks cannot and do not lend out reserves.6

Reserves have nothing to do with lending. They’re used for payment settlements between banks7, not lending.

So we will now discard the fractional reserve model of banking. We simply do not live in a monetary system that operates by those rules.

How do banks create money?

By making loans. Seriously.

It seems intuitive to think that when you borrow money from a bank that the money “comes from” somewhere.

It doesn’t.

When a bank funds a loan, they create entries in their ledger.

They create an account for you, and “mark it up” which simply means they enter a number of dollars (or pounds, or yen, or euros, etc) into the account. That account is an asset to you and a liability to the bank. It’s a liability to the bank because you can withdraw the money at any time, and if you borrowed the money for a specific purchase like a car or a home, you will be doing so.

They also create a loan contract, which when signed by both parties becomes a loan obligation, saying you owe X amount and will pay Y amount every month for Z months. This is a liability to you as you’re the one making the monthly payments, and an asset to the bank as they’re the one receiving the payments.

Is any part of money creation “real”?

Yes.

The loan agreement is definitely real.

It’s a contract between you and the bank and is enforceable in court. The money in your account is real, even though the bank created it by typing numbers into a computer database. And your payment obligation is real, as defined in the loan agreement.

And this is where money comes from?

In a word, yes. At least most of it.

This means:

Almost every dollar that exists was created by a bank when they funded a loan, and therefore almost every dollar that exists is owed by someone to a bank.

As banks make loans, money is added to the economy. As loan payments are made, money is subtracted from the economy.

We don’t have a fractional reserve banking system, we have a credit expansion banking system.8

The amount of money in circulation literally expands and contracts with demand for credit. Literally. Hence the name “credit expansion”.

"They also create a loan obligation saying you owe X amount and will pay Y amount every month for Z months."

I argue that the borrower, not the bank, is the one who creates the loan obligation. The bank can't force someone to be indebted to it.

Lending involves a contract. Each side must offer consideration to the other. I'd say the most concise way to describe what consideration it offers is a transfer of some of their (raw) net worth.